Creative Money LLC provides professional financial planning services to the Seattle community. The company's team is comprised highly-trained professionals, who are committed in helping their clients achieve financial freedom. Mindy, who is the founder of this company, has a master's Degree in Business Administration and more than 20 years of experience working in big financial institutions. She holds professional coaching certifications.

Advice only from financial advisors

Only financial advisors in Seattle can provide advice and not offer any financial planning. They advise clients on their portfolio investments and give suggestions, but don't push clients into specific investments. Having said that, they also provide information about potential investment opportunities, which can be valuable. Many clients have reservations about using the services of financial advisors.

A great way to establish a long term investment strategy is to engage a financial adviser. They can help build an investment portfolio to help you reach your financial objectives, including retirement. A local financial advisor will also be familiar with the Seattle economy, including the cost of living and the employment opportunities.

Financial advisors who charge a fee

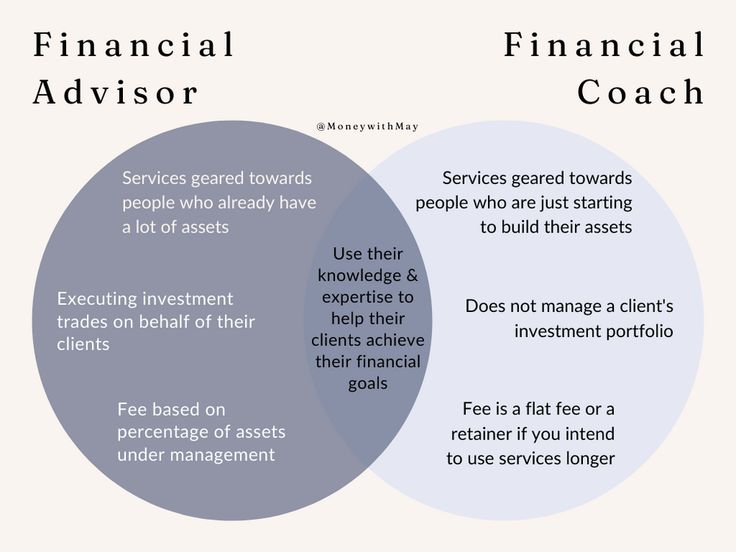

There are two types Seattle financial advisers: fee-based advisors and fee-only. A fee-only advisor is compensated only through fees from their clients. This is in contrast to a fee-based financial advisor, who receives incentives or commissions from the financial product companies. The result is an inherent conflict. Furthermore, a fee only financial advisor is required to act exclusively in clients' best interests.

A fee-based financial advisor will charge a fee that varies from client to client. A fee for services varies from $600,00 to $1 million, but it is usually based on the client's net worth. Many fee-based financial advisors in Seattle offer comprehensive wealth management strategies. The fee-based advisors are able to help with many other areas, including portfolio management and estate planning.

Wealth management firms

Seattle wealth management agencies offer a range of services which include investment management and financial planning. They help individuals, companies, and pension and profit sharing plans achieve their financial goals. They provide a variety of financial management strategies, including investment and financial planning that can be tailored to each client's unique financial situation.

Some of the top wealth management firms in the Seattle area include Miller Advisors, an independent fee-only wealth management firm. The firm offers complete services such as investment management and retirement planning. The firm's team includes certified financial planners, estate planners, and attorneys. The team has extensive experience helping families manage their financial needs, and has a combined 50 years of experience.

The cost of working as a financial advisor

Fees for financial advisors vary depending on whether the fee is hourly or fixed. Some financial advisors charge an annual fee of 1% of the AUM. Others charge by the hour. Asset management fees are charged at a range of $230 to $7500.

It's important to know how much each advisor will charge before hiring one. You may not need certain services and some advisors will charge you an hourly fee. There may also be a onetime fee charged for limited questions. A great financial advisor will strive to establish a long-lasting relationship with clients.

FAQ

Who hires consultants

Many organizations hire consultants to assist with projects. This includes small businesses, large corporations and government agencies.

Some consultants work directly for these organisations, while others freelance. The hiring process will vary depending on the complexity and size of the project.

There will be many rounds of interviews for consultants when you are looking to hire. Only then can you select the right person to fill the position.

What are the types of contracts available to consultants?

Standard employment agreements are signed by most consultants when they are hired. These agreements specify how long the consultant will be working for the client and what he/she will be paid.

Contracts will also outline the areas of expertise and compensation for the consultant. An agreement could state, for example, that the consultant will offer training sessions, workshops and webinars.

Sometimes, the consultant simply agrees that a specific task will be completed within a set time frame.

Many consultants also sign independent contractor agreement in addition and standard employment agreements. These agreements allow the consultant work on his/her own but still receive compensation for his/her efforts.

Do I need to seek legal advice?

Yes! Yes. Many consultants sign contracts without seeking legal advice. This can cause problems later on. For example, what happens to the contract if the client terminates it before the consultant has completed? Or, what happens if the consultant doesn't meet the deadlines set forth in the contract?

To avoid any potential problems, it is best to consult a lawyer.

How do I choose a consultant?

There are three key factors to be aware of:

-

Experience - How experienced is this consultant? Is she an expert, beginner, intermediate or advanced consultant? Is her resume a proof of her skills and knowledge?

-

Education – What did the person learn in school? Did he/she take any relevant courses after graduating? Is there evidence that he/she learned from the writing style?

-

Personality: Do you like this person or not? Would we hire him/her to be our employee?

-

These questions can help you determine whether the consultant is right for your needs. If there are no clear answers, then it might be worth an initial interview to learn more about the candidate.

What skills is required to consult?

An effective consultant must have strong interpersonal skills as well as analytical skills. This is vital because you may not understand the scope of your work. You need to be able to manage people quickly and solve problems efficiently.

Excellent communication skills are also essential. Most clients expect an answer within 24 hours. If they don't hear back from you, they assume you aren't interested. It is vital to inform them and make sure that they are fully informed.

What is a consultant?

A consultant is someone who offers services to others. It's not just a job title; it's a role where you help others achieve what they want from life. This involves helping them to understand their choices and making the right choices.

Consultants are experts in finding solutions to the problems and challenges that arise while working on projects. They can provide guidance and advice on how to implement the solutions.

Consulting should be able address questions related to law, finance and technology.

Statistics

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

External Links

How To

How do you find the best consultant?

Ask yourself what you want from your new consultant before you start looking. Before you start looking for someone to work with, it's important that you know your expectations. It is important to make a list with all the requirements you have for a consultant. These could include professional expertise, technical skills and project management abilities, communication skills, availability, and other things. Once you have identified your requirements, you might consider asking friends and colleagues to recommend you. Ask your friends or colleagues about any negative experiences they have had with consultants, and compare their recommendations with yours. Do some internet research if they don't have recommendations. There are many websites that allow users to leave feedback about their previous work experiences, such as LinkedIn and Facebook, Angie's List or Indeed. You can use the comments and ratings left by others to help you find potential candidates. Finally, once you've got a shortlist of potential candidates, make sure to contact them directly and arrange an interview. In the interview, discuss your needs and ask them for their suggestions on how you can achieve them. It doesn’t matter who recommended them to you, just make sure they understand what you are trying to achieve and how they can help.